New content material on %%

For the plane engine market, newer is probably not higher – but

New-generation engines are delivering higher effectivity, but in addition higher prices. Vanessa Gu recaps Cirium Ascend Consultancy’s newest webinar on the plane engine market, exploring the impacts of this shift and the way the business is adapting.

Vanessa GuAsia Finance EditorCirium

Energy to carry out: The plane engine market was broadcast reside Thursday twenty fifth September.

The price of sustaining new-generation engines is predicted to be increased than current-generation engines even with enhancements in {hardware}, provide and the easing of MRO constraints.

That’s as the newest engines are requiring extra store visits than these of 10 years in the past as extra environment friendly gas burn has inadvertently resulted in faster put on and tear, and shorter time on wing.

Whereas ongoing enhancements akin to Pratt & Whitney’s GTF Benefit programme and extra sturdy blades on the CFM Worldwide Leap engines are anticipated to allay a few of these points, “it nonetheless is an altogether totally different degree of value on engines now in contrast with the earlier technology,” says Giles Thomas, Managing Director at Charlotte Parker Associates.

“So it can get higher. I don’t suppose, sadly, we’re going to get again to the degrees of time on wing and product robustness, or reliability … that we, for instance, noticed comparatively now on the CFM56, V2500, widebody, GE CF6, Trent 700 which have been fairly predictable,” he provides, whereas talking on a panel Cirium’s ‘Energy to carry out: the plane engine market’ webinar.

On the identical time, the unreliability of new-generation engines has made an rising variety of airways “a bit reluctant to look into the brand new expertise plane additionally as a result of there’s a number of threat which they obtained to tackle that,” says Mahesh Kumar, chief government of Capital A subsidiary Asia Digital Engineering, who was additionally on the panel.

That reluctance has been exacerbated by engine producers transferring away from power-by-the-hour agreements as OEMs have underestimated the quantity of upkeep and restore their engines want, says Kumar.

Coupled with the continued provide chain crunch and MRO slot constraints, the values and lease charges of previous and new technology engines have rocketed prior to now six years, leaving airways to bear the brunt of added prices.

“That’s the fascinating a part of it – your product [new generation engines] will not be dependable, the worth of your engine went up as a result of the calls for spiked up, so on that I’d say the airways are on the struggling a part of it,” Kumar states.

Engine values and lease charges

The market lease charges of narrowbody and widebody engines have gone up by 34% and 23%, respectively, whereas market values are up 14% and 5%, respectively, in comparison with September 2019, particulars Cirium’s Senior Valuations Analyst Lionel Olonga on the webinar.

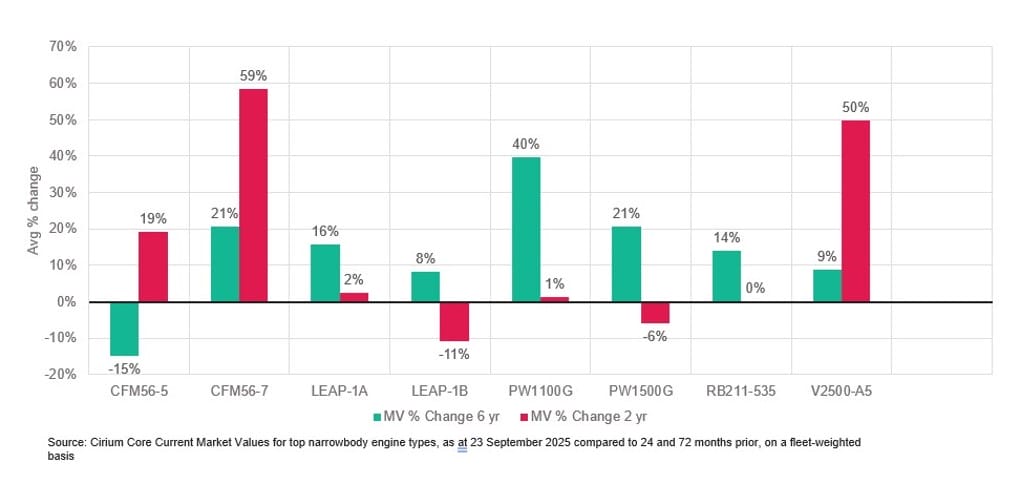

Breaking it down additional for narrowbody engines, the rise in worth is most pronounced during the last two years for CFM56-7B engines that energy Boeing 737-800s and Worldwide Aero Engines V2500 powering Airbus A320ceos.

The rise in values for -7Bs are primarily pushed by the NGs working for longer resulting from supply delays, whereas the rise for V2500s are resulting from operators which have A320neos powered by Pratt & Whitney’s PW1100G engines of their fleet renewal plans rising using their present -ceos, explains Olonga.

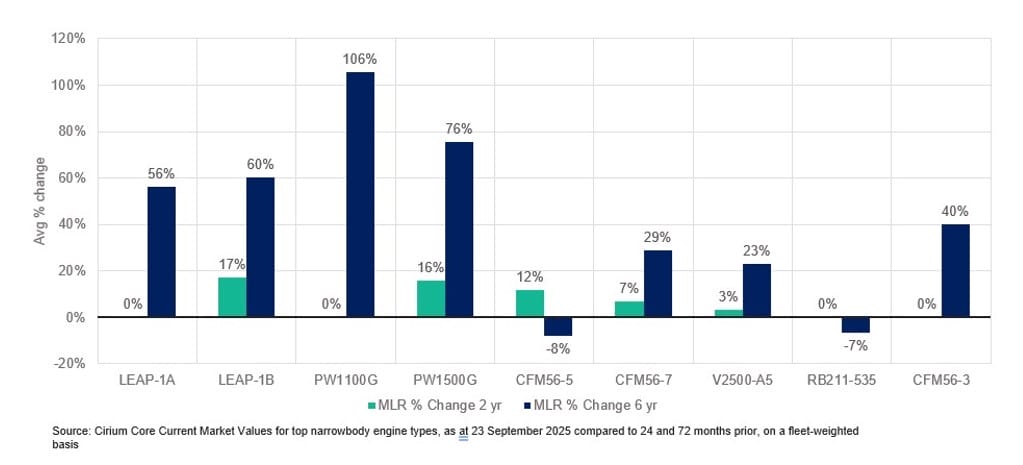

On market lease charges, PW1100G has seen a greater than two-fold enhance on lease charges in contrast with 2019, whereas the Leap-1A and -1B engines have seen a greater than 50% enhance.

These will increase come on the again of an uptick in upkeep prices and inexperienced time worth for brand spanking new technology narrowbody engines – such because the Leap and GTF – which have elevated by over 50% within the final six years, whereas these for CFM56s and V2500s are 10-30% increased, says Olonga.

Widebody engines additionally inform an identical story, with upkeep prices and inexperienced time values up 60% for brand spanking new technology engines and a 10-30% uptick for older technology engines.

Gradual decline to sane pricing

The present points dealing with the business have been described as an ideal storm that’s anticipated to reveal its tooth till the tip of the last decade.

Nonetheless, as the availability of latest plane will increase and as MRO constraints ease, there will probably be a “readjustment”, says Thomas, although he cautions it is going to be gradual and measured.

As older plane retire with the incoming new technology jets, Thomas is of the view that values of CFM56s or the V2500s “will definitely decline”.

“A decline, I ought to make clear, doesn’t imply … essentially, in a short time. And what I imply is decline from the present very excessive ranges at present” to “historic ranges pre-Covid” earlier than the plane sorts begin retiring in quantity, he says.

An instance of “excessive ranges”, he particulars, is how he heard anecdotally that “utterly run out” CFM56 engines with no efficiency left and “nearly carried out” life restricted components buying and selling for above $3 million.

“Due to this fact, that kind of elevated degree of worth, which is only an element of lack of MRO capability and lack of energy provide, that can disappear, so subsequently the engine values would, for that kind of engines, return to one million or much less,” he goes on to say.

Within the meantime, nevertheless, values for engines are anticipated to remain excessive as airways proceed to grapple with a litany of points starting from MRO slot constraints and unreliability of latest technology engines.

Kumar says the necessity for spares will not be merely about producers producing the required engines but in addition associated to elevated store visits resulting from engine reliability points.

And store visits now have longer turnaround instances and elevated prices, and from an airline’s perspective, “it would make sense to get one other engine in, quite than placing the older engine for a store go to,” states Kumar. This in flip additional drives up values.

No matter when the gradual fall of values would possibly occur, Thomas cautions: “If one is investing in engines at present, one must be very conscious of what engine construct commonplace one is investing in, so that you’ve got some information and competence within the longevity of that individual engine variant of any new engine expertise engine.”

Untimely plane partout will proceed (for now)

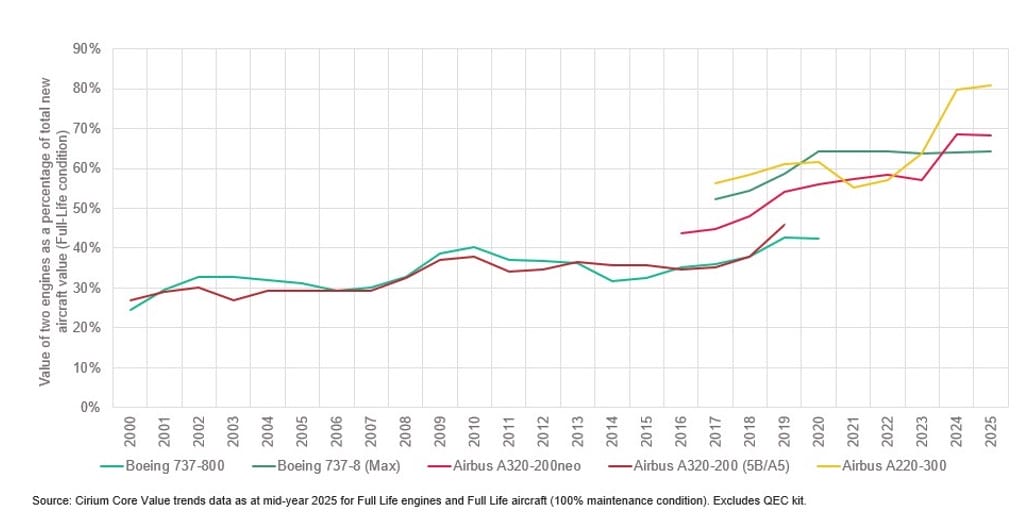

There are not less than 15 A320neo household plane which were retired for part-out as the worth of a pair of engines is hovering near 70% of complete plane worth for the sort, says Olonga.

With the worth of engines taking on such an enormous portion of plane worth, the curiosity in buying plane for the engine or for parting them out is predicted to proceed.

Thomas remembers how one airline stated it was doing 4 engine adjustments within the subsequent 10 days “purely to maintain its fleet flying”, highlighting a “horrendously advanced state of affairs which isn’t going to be cured rapidly”, that means demand for part-out engines will stay excessive.

On the identical time, for lessors, leasing an plane at a worth they want whereas making an allowance for the excessive engine values could also be exhausting for airways to swallow.

“Due to this fact the answer for engines is definitely fairly neat, and the byproduct of that is also all of the serviceable used materials from the remainder of the plane and airframe,” says Thomas.

Kumar likewise concurs that curiosity in parting out new technology plane will proceed, recounting that an airline was keen to lease a widebody simply to drop each the engines and put it again to operations.

“It makes full sense for the lessors to simply drop the engines from the plane after which lease it the place they will make a greater margin out of it, quite than leasing the entire airplane,” he says, including that it additionally reduces transition and redelivery prices.

Regardless of the continued curiosity, it’s extensively acknowledged that the parting out of six-year-old plane with years of service left resulting from half shortages and restricted MRO slots is very unsustainable.

Whereas Thomas expects the state of affairs to proceed within the shorter to medium time period, he hopes to see “frequent sense and regular guidelines of the aviation business returning in a few years’ time”.

Energy to carry out: The plane engine market is now obtainable to look at on demand.

You may additionally like …

SHOW MORE ARTICLES

The put up For the plane engine market, newer is probably not higher – but appeared first on Cirium.