New content material on %%

South Facet Story – Southeast Asian airways’ stalled development

Following the information of AirAsia’s deal for 70 Airbus A321XLRs, Thomas Kaplan examines the order backlogs of Southeast Asian ULCCs and asks whether or not the area’s air journey market is rising as quick as their ambitions.

Cirium Ascend Consultancy is trusted by shoppers throughout the aviation trade to supply correct, well timed, and insightful plane value determinations. The crew gives the valuations and evaluation the trade depends on to know the market outlook, consider dangers and establish alternatives.

Uncover the crew’s trade studies & market commentaries. Learn their newest knowledgeable evaluation, viewpoints and updates on Thought Cloud.

Staff Perspective

Thomas KaplanSenior Valuations ConsultantCirium Ascend Consultancy

Information that AirAsia had signed for as much as 70 A321XLRs earlier this month actually raised eyebrows. An airline that already has such a big backlog, and which continues to be rising from restructuring, mustn’t, on the face of it, be including extra orders. Studying past the headlines, nevertheless, the 70 A321XLRs are solely commitments, not agency orders. AirAsia Group’s agency orderbook stands at 402 plane, all A321neos (together with 20 XLRs) save for 15 A330neos. Its in-service passenger fleet includes solely 219 plane (largely A320-family jets, plus 24 A330neos), which continues to be fewer than the 240+ it was working in 2019.

In 2015, we ready a slide deck displaying the airways in Asia-Pacific that had orderbooks far bigger than their in-service fleets. Two airways have been outliers: Lion Air and AirAsia. Our message on the time was these airways had managed double-digit development charges prior to now and it was theoretically potential for them to soak up their orderbooks in the event that they managed to proceed the identical development development.

There have been causes to be optimistic about Southeast Asia’s air journey market. The 640 million individuals unfold throughout islands and slender peninsulas have been getting richer and so they’d in the end take a flight. Tourism was booming, and it appeared Chinese language vacationers would offer an limitless supply of demand. The extremely low-cost provider (ULCC) mannequin utilized by AirAsia and Lion Air was seen as one of the simplest ways to seize and drive that development.

In the end, the story of fast-paced development was to not final. Financial and geopolitical components together with the aggressive dynamics of a ULCC turf battle all contributed to a decade of slowed development.

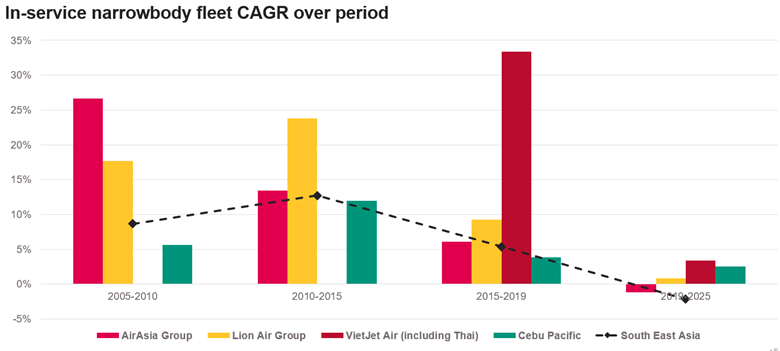

The chart under reveals the compound annual development fee of the in-service narrowbody passenger jet fleet of Southeast Asian airways with the biggest orderbooks, in contrast with the area’s general fleet development. Taking a look at five-year durations (however shifting 2020 to 2019 with a purpose to isolate pre-pandemic figures), we are able to see 2005-2015 was a time of very speedy development for AirAsia and Lion Air with sustained durations of over 20% annual development. The Southeast Asian fleet additionally grew at round 10% per 12 months all through that decade.

The interval of 2015-2019 introduced a marked discount, to single-digit ranges, with AirAsia’s narrowbody fleet rising on the identical tempo as the remainder of the area’s fleets. VietJet, which was Vietnam’s ULCC, tripled in measurement from 24 to 76 plane, however added fewer plane than Lion Air did and solely barely greater than AirAsia.

Since 2019, development has been a battle for all these gamers. Over the previous six years, the Southeast Asian narrowbody jet fleet truly shrunk at a fee of 1% per 12 months, and the very best ULCC compound annual development fee was VietJet’s 3%, a far cry from the >20% the area’s high-flyers had achieved prior to now.

Filters: Narrowbody jets, passenger utilization, years calculated as 1 July, firm class Airways. Southeast Asia is outlined as: Brunei, Cambodia, East Timor, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam.Supply: Cirium Fleets Analyzer

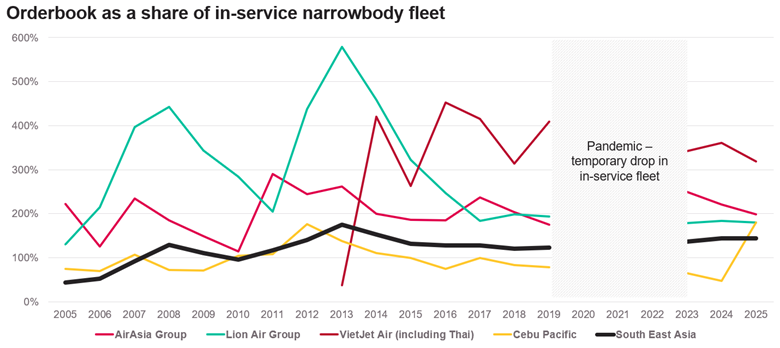

The stalled development raises questions concerning the remaining substantial orderbook. Southeast Asian Airways have 1,366 narrowbody passenger jets on order, representing 144% of the present in-service fleet. By comparability, the world’s backlog share of in-service narrowbody fleet is just 66%. Massive Southeast Asian ULCCs’ backlog will be 180% to over 300% of their in-service fleets, that are about the identical stage as they have been 10 years in the past. The chart under reveals this, whereas omitting the pandemic years during which the momentary parking of plane led to a small in-service fleet, artificially inflating orderbook share.

Filters: Narrowbody jets, passenger utilization, years calculated at 1 July, firm class Airways. Southeast Asia is outlined as: Brunei, Cambodia, East Timor, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam.Supply: Cirium Fleets Analyzer

Southeast Asian airways should not taking deliveries quick sufficient to make a dent of their orderbooks and produce them again to steady ranges. Provide chain points which were plaguing the trade are partially in charge, however the slowing fleet development started earlier than the pandemic and the Max grounding. Southeast Asia’s peak for passenger narrowbody jet deliveries was again in 2014 at 126. That’s greater than has been delivered because the begin of 2020.

A substitute cycle quite than a development cycle might lastly drive deliveries, however there are issues with orders positioned up to now prior to now. AirAsia positioned a large order for 200 A320neos again in 2011. To this point, solely 55 A320neo household plane have been delivered to the group. It might have obtained a very good deal from Airbus on the time, however what does 14+ years of escalation do to supply pricing? Orders have been doubtless renegotiated throughout the pandemic because the group additionally went via normal restructuring, however escalation continues to extend the eventual supply pricing.

Southeast Asia just isn’t the one place with a really giant narrowbody jet orderbook as a share of in-service fleets. India, Saudi Arabia and Hungary (house to Wizz Air) stand out with orderbook shares at over 200%. It may be argued these have development potential in numerous methods, however the ULCCs of Southeast Asia seem to have over-ordered given the development of the final decade.

This doesn’t threat inflicting world oversupply, as OEMs can’t ship quick sufficient to satisfy the worldwide demand in any case. Nevertheless, the backlog will increase the chance for these airways with rising liabilities by way of escalating supply pricing in an ultra-competitive market which seems to not be rising as quick as their ambitions.

You might also like …

SHOW MORE ARTICLES

The submit South Facet Story – Southeast Asian airways’ stalled development appeared first on Cirium.